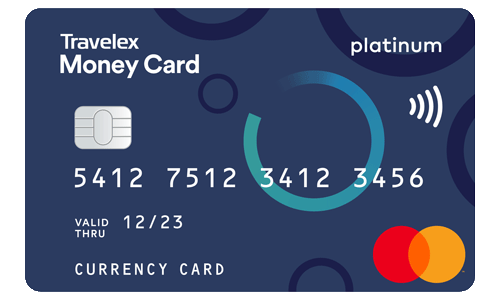

The Travelex Money Card stores money in a savings account so that you can use the Singapore dollar (SGD) and any other foreign currency you prefer in Singapore.

With the Travelex Money Card, you can shop at millions of outlets around the world (even for online shopping) wherever Mastercard is accepted. There is also no international ATM fee with using the Travelex Money Card1.

Travelex Money Card for Singapore

Designed for convenient and affordable travel, the Travelex Travel Money Card is an award-winning multi currency card with no foreign currency conversion fee^. The Travelex Money Card is also compatible with all Mastercard establishments.Enjoy cash advance fee-free withdrawals, great online Singapore dollars exchange rates, and all the benefits of prepaid cards with the Travelex Travel Money Card.

Easy Currency Bundle Options for your Trip

Singapore Singapore |

|---|

| Singapore dollar |

Singapore Singapore |  Hong Kong Hong Kong |

|---|---|

| SG dollar | HK dollar |

Singapore Singapore |  Hong Kong Hong Kong |

|---|---|

| SG dollar | HK dollar |

Make your Own Mix Make your Own Mix |

|---|

| Select currencies of your choice* in CASH and/or CARD |

UNLIMITED FREE overseas ATM withdrawals2

Highly competitive exchange rates1

NO fees when you buy online

$0 Currency conversion fee^

24/7 Global Assistance

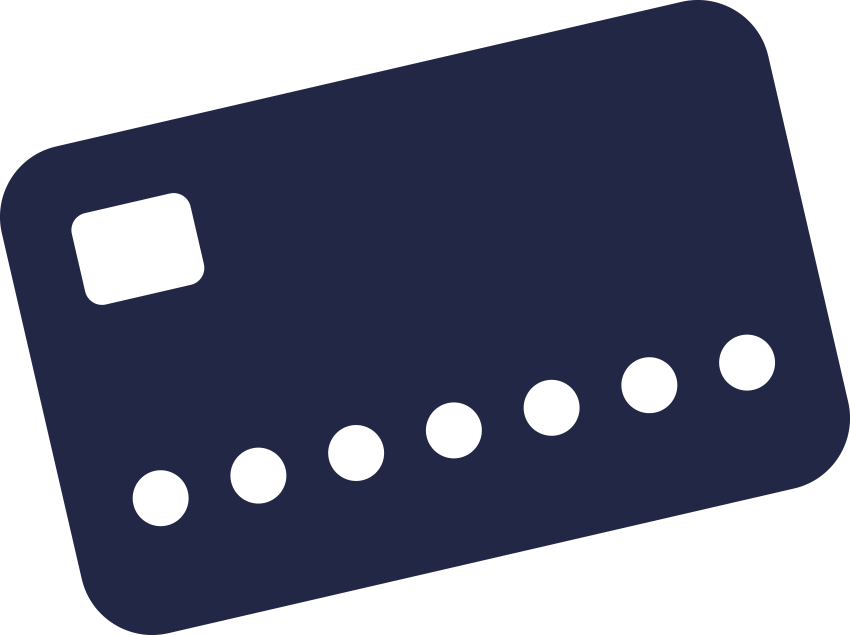

Convenient Mobile App

Download it here

Shop at millions of outlets wherever Mastercard is accepted

Exclusive offers with Mastercard PricelessTM Cities

No account or membership required

Order your travel card

Order your Travelex Money Card and Additional Emergency card online or in-store

Get your travel card

Collect from a Travelex store near you

Register for My Account

Simply activate your card by registering your account via the app or online

Top Up

Manage and check your balance online and on your mobile

Experience the benefits

- Top up your Travelex Money Card wallet

- Check your balance and move funds between currencies

- Instantly freeze and unfreeze your card

- Reveal your PIN and card details for online shopping

The app requires Android 8.0 and up or iOS 14.0 or later.

Compatible with iPhone, iPad and iPod touch.

NO fees online

Withdraw daily up to NZ$3,000 (or currency equivalent)

Maximum Card limit of NZ$75,000

Free initial and replacement card

In addition to the currency exchange rates, the following fees and charges apply to the Travelex Money Card. The fees and charges may be altered by EML at its discretion by providing you with at least 20 days prior notice.

NZ$, AU$, US$, GB£, EU€, CA$, HK$, SG$, JP¥ .

*The currencies available may vary from time to time. Before you make a decision to acquire the card, please check with the Distribution Outlet or on this page.

Load/reload in NZD: the greater of 1.0% of the initial load/reload amount or NZD$10.00. Load/reload in other currencies: zero.For example, for a Distribution Outlet charging a 1.0% initial load fee, if you purchase a Travelex Money Card and load NZD$800, you would be charged (NZD$800 x 1.0%=NZD$8), unless a minimum fee of NZD$10 applies.

FREE

FREE

This fee is set and charged by Mastercard Prepaid Management Services.

1%

NZ$5.00

FREE

Some ATM operators may charge an additional withdrawal fee.

2.95%

FREE

- Charged at the start of each month if you have not made any transactions on the card in the previous 12 months

- Unless your card is used again, or reloaded, this fee applies each month until the card is closed or the remaining card balance is less than the inactivity fee.

NZ$4.00 per month

FREE

Charged when you close or Cash Out your Travelex Money Card. This fee is set and charged by MasterCard Prepaid Management Services.

NZ$10.00

This is applied when you move your funds from one currency to another currency, or when you request a Cash Out to close your Travelex Money Card and you have funds in a foreign currency

At the then applicable retail foreign exchange rate determined by us. This rate reflects MasterCard Prepaid Management Service’s cost price plus a margin determined by MasterCard Prepaid Management Services. We will notify you of the rate that will apply at the time you allocate your funds from one currency to another and this rate (inclusive of the margin) may be less favourable than the foreign exchange rate for Online reloads where you allocate funds in a foreign currency.

Applied when a purchase or ATM withdrawal is conducted in a currency either not loaded or sufficient to complete the transaction and the cost is allocated against the currency/ies used to fund the transaction

MasterCard® rate plus 4.00% of the transaction value. The MasterCard rate is the exchange rate determined by MasterCard to be their wholesale rate or the government mandated rate in effect in the day the transaction is processed by MasterCard.

At the then applicable retail foreign exchange rate determined by us. This rate reflects MasterCard Prepaid Management Services’ cost price plus a margin determined by MasterCard Prepaid Management Services. For online reloads we will notify you of the rate that will apply at the time you book your transaction (further terms and conditions apply and will be provided to you at that time).

MasterCard® rate plus 4.00% of the transaction value. The MasterCard rate is the exchange rate determined by MasterCard to be their wholesale rate or the government mandated rate in effect in the day the transaction is processed by MasterCard.

Limit

One (1)

- Initial purchase: NZ$250 or currency equivalent

- Top-ups: NZ$100 or currency equivalent

The maximum amount you can load on the card at the time of the initial online purchase is NZ$10,050 equivalent.

(i) to a maximum of NZD10,050.00 per single top-up; and (ii) to a maximum of NZD10,050.00 per top-up within 24hrs; and (iii) to a maximum of NZD20,000.00 top-up within 21 days. NZ$20,000 or currency equivalent

Some ATM operators may set their own withdrawal limits which may be lower than this limit.

NZD$3,000 or currency equivalent

NZD$15,000 or currency equivalent

NZD$75,000 or currency equivalent

NZD$75,000 or currency equivalent

Some financial institutions may set their own withdrawal limits which may be lower than this limit.

NZD$400 or currency equivalent

NZD$0.00 (No overdraft facility available)

Fees & Limits

See fees and limits here- Being able to lock in fixed foreign currency exchange rates before travelling

- Storing your money in a secure savings account

- Avoiding annual fees, hidden fees, ATM withdrawal fees, and any reload fee

- Feeling safe when local spending

The Travelex Singapore travel card is an award-winning money card that exchanges and stores SGD prevailing exchange rate. Similar to standard debit cards (however, not like air miles credit cards), the Travelex Singapore travel card can be used to make purchases in stores and to withdraw cash at ATMs while travelling.

You can buy currencies in addition to SGD and store them all within the same money card. In this way, you can access cash in multiple currencies whenever need be.

Travel money cards can be incredibly helpful to have when spending overseas. They make foreign currency transactions easy and, in the case of Travelex, saves you money on fees. This means you can avoid paying an annual fee and save money (compared to using a credit card).

Other benefits of travel money cards include:

- Being able to lock in fixed foreign currency exchange rates before travelling

- Storing your money in a secure savings account

- Avoiding annual fees, hidden fees, ATM withdrawal fees, and any reload fee

- Feeling safe when local spending

The best travel card for Singapore is the Travelex Travel Money Card. It is a great option for storing and exchanging money during your travels. Not only is it majorly fee-free, but it is also quick and easy to reload money into your travel money card account online.

Find a store near you or order a travel money card online today.

Card payments are widely accepted in Singapore; however, cash is always beneficial to have on hand when visiting areas such as traditional markets. Travel money cards are great for both card and cash use, as users can simply withdraw money from a nearby ATM (without any ATM withdrawal fees1) whenever they need it. While using the travel money card, converted cash is stored in an account similar to a standard bank account.

You can use the Travelex Money Card in multiple situations where you may need to make a purchase in the local currency or withdraw cash. It can be used for hotel transactions, to purchase travel insurance, and for a host of other purchasing purposes.

IMPORTANT INFORMATION TO CONSIDER BEFORE CARRYING OUT YOUR TRANSACTION

1. The currencies available in respect of Travelex Money Card may vary from time to time. Before you make a decision to acquire the card, please check the available currencies online or by asking in store.

2. Please be advised that although Travelex does not charge ATM fees, some operators may charge their own fee or set their own limits. Please check with the ATM before using.

3. Transacting via some online merchants may incur a surcharge.

* Lock in your exchange rates mean the exchange rate is locked in for the initial load only. The exchange rates for subsequent reloads will be set at the prevailing exchange rate at the time of the transaction. We will tell you the applicable exchange rate before you confirm your reload transaction on travelex.co.nz. If you wish to make a purse to purse transfer to move funds already on your card to another currency, please log in to my account. If you make a purse to purse transfer, you will receive a different exchange rate to the rate you receive when you load funds directly on to your card. You will be notified of the applicable exchange rate before your confirm your purse to purse transfer and this rate may be less favourable than the rate you receive if you reload your card online at travelex.co.nz. Different exchange rates will apply to reload transactions conducted directly via Bank Transfer or Bill Payment (i.e. without booking an online transaction). For more information, please read the Terms and Conditions.

Travelex Money Card is an unsecured debt security issued by EML Payment Solutions Limited (“Issuer”). Travelex Money Card is not guaranteed by the Issuer or any of its related companies or any other entity.

A Product Disclosure Statement is available free of charge from Travelex.co.nz. Information has been prepared without taking into account your objectives, financial situation or needs and you should consider the appropriateness of the information about the Travelex Money Card facility before making any decisions about whether to acquire or continue using the prepaid facility. You should also refer to the Terms and Conditions, Online Ordering Terms and Conditions, Online Prepaid Card Reload Terms and Conditions, and Privacy Policy.

Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

CASH

CASH CARD

CARD

Australia

Australia

Europe

Europe

US

US

Japan

Japan

UK

UK

Canada

Canada

Hong Kong

Hong Kong

Singapore

Singapore